Resources

Explore our all-encompassing resource center which includes the most recent news, helpful blogs, informational videos, expert-level webinars, and complex publications. This archive can help you to solve the confusing puzzle that is Human Resources, and we hope our collection of resources continues to help you put the pieces together.

News

PuzzleHR and Evertreen Celebrate Environmental Milestones

Tampa, FL — PuzzleHR, a leading provider of fractional human resources solutions, is excited to announce the continued success of its partnership with Evertreen, the

PuzzleHR Announces the Launch of Survey360°, the Leadership Development Solution to Transform Potential into Performance.

Tampa, FL – PuzzleHR, headquartered in Tampa and a leading provider of fractional managed HR solutions nationally, has launched its new leadership development software, Survey360°.

Recent Blog Posts

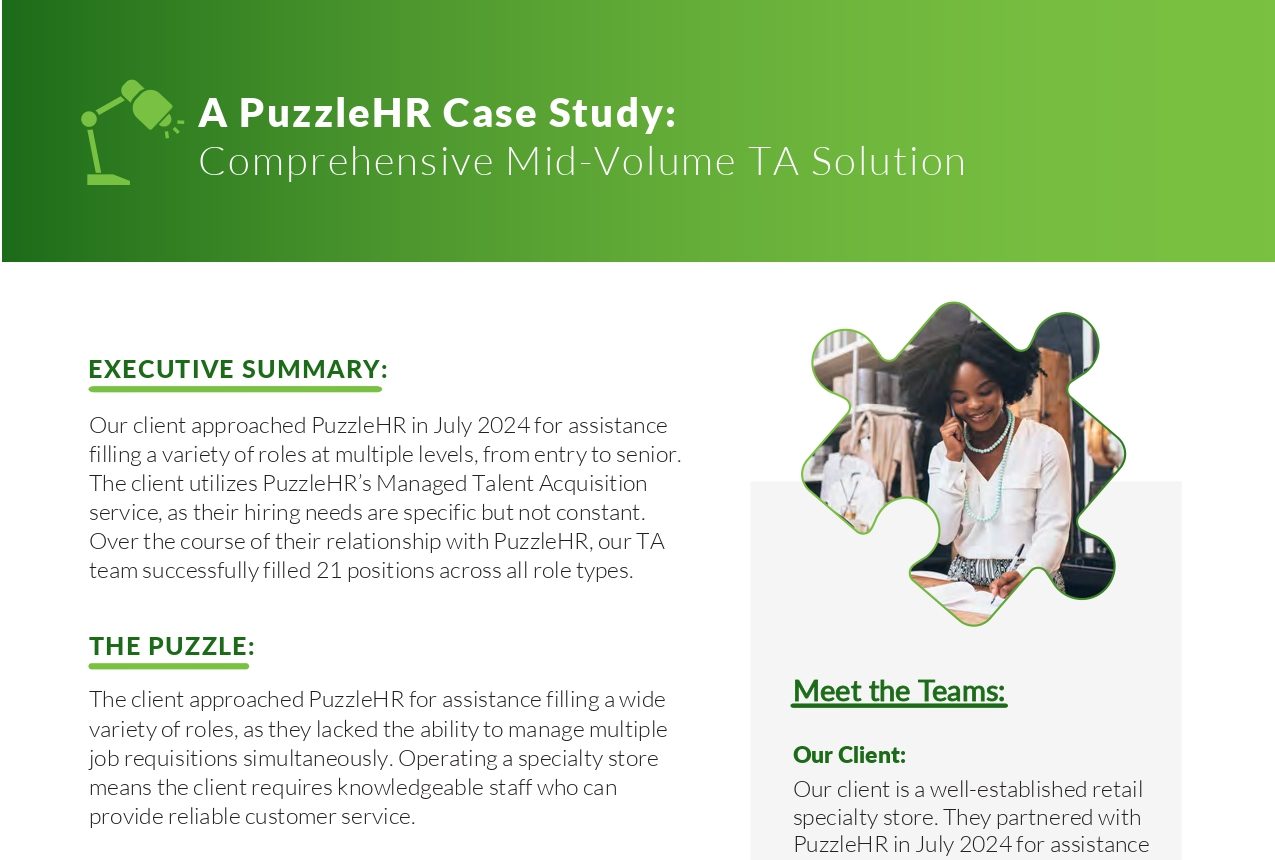

What Is Recruitment Process Outsourcing?

In the competitive hiring landscape, finding and attracting top talent has become one of the biggest challenges facing businesses of all sizes. Whether you’re scaling

Why Proper Employee File Maintenance Matters When Switching HCM Systems

Switching from one Human Capital Management (HCM) system to another may appear straightforward, but the reality of moving employee records often proves much more complex.

What Is Fractional HR? A Smarter Way to Build Your HR Strategy

In the modern workplace, agility and efficiency have become more than just buzzwords, they’re key components of business success. Whether you’re operating a startup, a

Podcasts